Having a great product or service is the entry bar to a successful business in a world where Google will give your customer 25 options only a click away. Long term competitive moats are built by brands. The one metric that I see too easily dismissed is how much did you spend to acquire a customer for last month?

If you don’t know…you can easily calculate your CAC by simply dividing all your marketing expenses by the number of customers acquired last month by the money that was spent to acquire them. For example, if a company spent $10,000 on marketing (people, tools, media) last month and acquired 1,000 customers, your CAC would be $10.00.

You should obsess over this number with your marketing team because we see 40%-60% of new products die on the rocks of Acquisition Costs. The argument often goes, Well we will make our money on the 2nd, 3rd, or 4th sale (ie, lifetime value, LTV) of your customer so don’t fret over your initial CAC. But that misses the point. Let’s take the recent IPO of Lyft as an example of how you can get into trouble on this really quickly. Lyft acquires a customer in aggregate for $32 and makes $51 or a net $19. With 78% of Lyft customers churning within one year this requires a massive marketing machine to keep the business growing (to the tune of $900 Million in R&D and G&A dollars). Which is why you see Lyft getting its share price hammered as the odds it is going to acquire 50 million more riders at $19 to justify its lofty valuation is remote. They need to drastically reduce their CAC to have a viable long term business.

Business is not like that! Unfortunately, all too often we see similar optimistic thinking that justifies a CAC that someone else is going to pay for down the line. We are not saying your CAC out of the gate or in a test phase won’t be high but you need to know where it needs to be in the long term to win.

How do I get my Customer acquisition cost down?

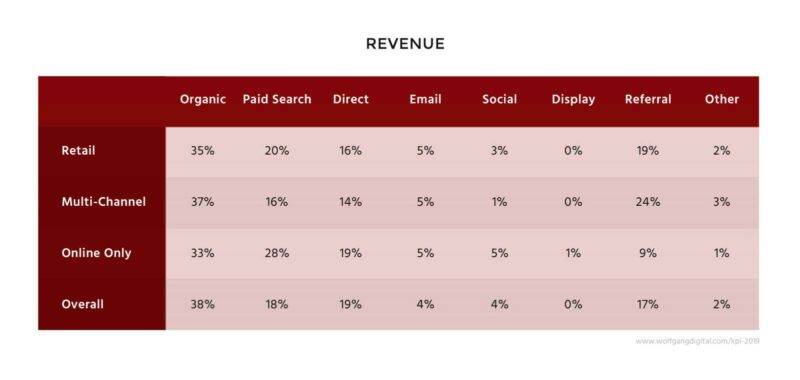

Focus on the basics: Organic Traffic, Paid Search, and Email. As you can see in the chart below they represent 60% of the revenue driven to most E-commerce sites and as we see from our client base as well. To keep it apples to apples we are going to pass on your direct traffic/revenue percentage as that will vary on the strength and age of your brand.

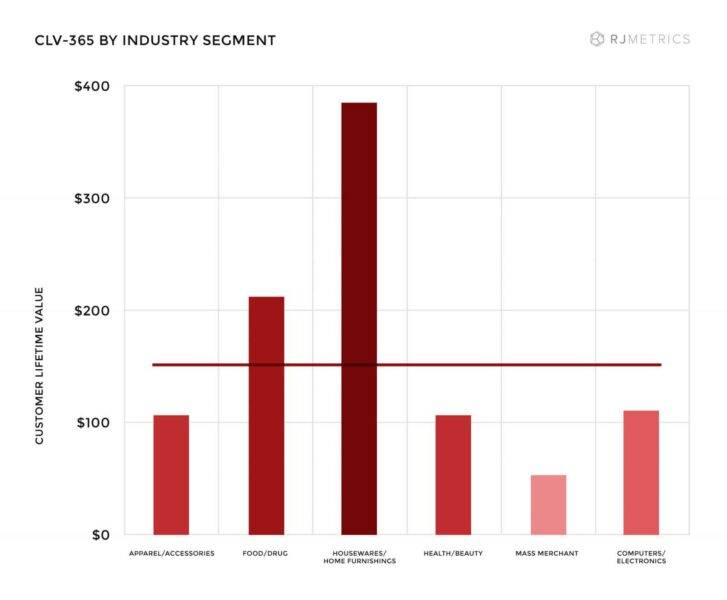

Let’s assume you have an $150 average lifetime order value:

If we take Industry benchmarks you could spend up to 33% of that or $49.50 on Customer acquisition cost but since we see most clients under report those costs I would aim for $25-$30 (16%-25%) in direct marketing costs knowing that you have additional overhead.

We can’t do 25%! But you can by focusing on the boring stuff:

- Improve the load time on your site as this has the highest correlation with more revenue.

- Do Technical SEO as you think your site is doing better than Google does.

- A/B/N test your way from 1.5% > 3% conversion rate. This is a big long term task but it can be done.

- Use Amazon as lower Customer acquisition cost channel.

- Rework your paid search campaigns to take advantage of all of Google’s new tricks (machine learning, scripts (weather, daypart, and so on).

- Look at reducing your Facebook and Display Ad spends as the combination of 21% Ad Fraud and higher Ad rates are driving that CAC up more than you think.

- Revienst that found budget into smart segmented Email to get people back to your site more often.

- Clean up your Google Tag Manager code and retargeting lists monthly vs quarterly.

- Write better-segmented copy for your buyers via Ads and focused landing pages.

- Test more and more often. If you do one test weekly = 52 tests vs 12 if you test monthly!

Do you need help getting your CAC down? Contact Us Today!