I can’t tell you when the next Recession is going to hit but I can say from the data we see it is closer than you think. We explore what you can do to get your company ready to market in this environment that we last experienced in 2008.

Indicators we track:

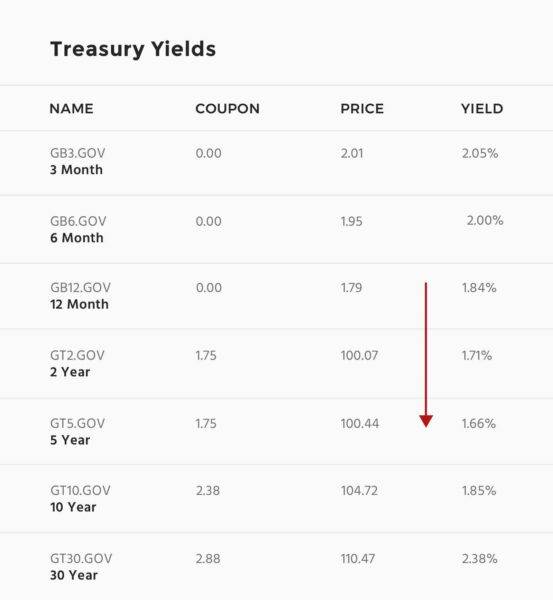

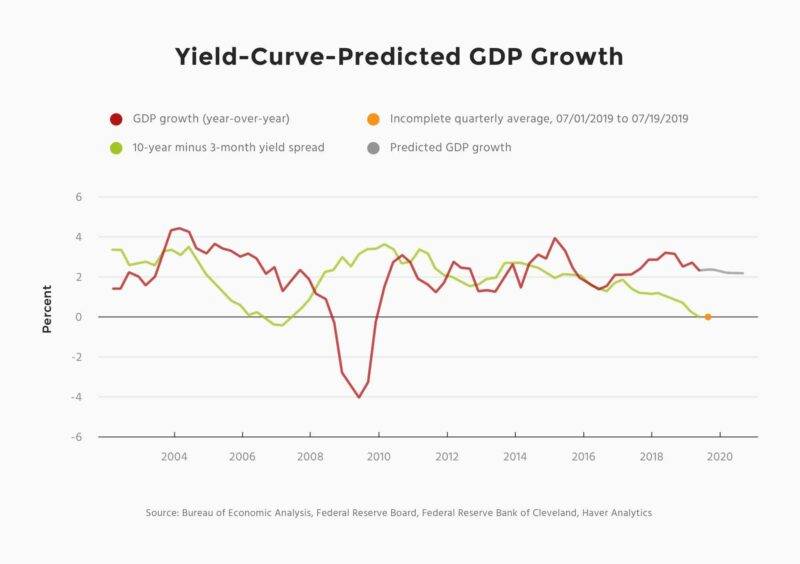

- Treasury Yields are inverted (the bond market will pay less for the same grade debt in the future) and the longer this continues the more likely we are to see a recession in the next 9+ Months.

While the Yield curve is not perfect, only a directional metric that has helped predict 7 of the last 10 recessions.

- The Federal Reserve cut interest rates a quarter point this week in the hope of giving us a future softer economic landing.

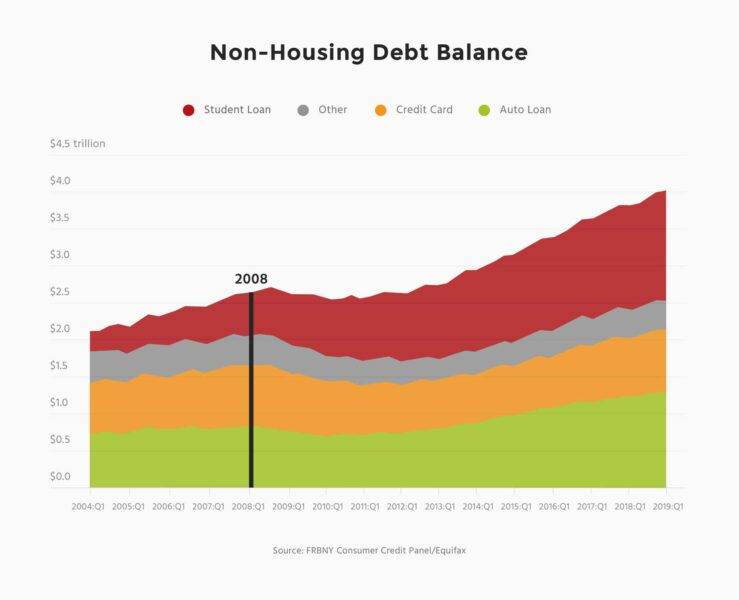

- Total household debt rose by $124 billion in the first quarter of 2019 to reach $13.67 trillion—$993 billion higher than the previous peak, set in the third quarter of 2008. We can see that student loans are the largest driver of that debt increase. This puts strains on the disposable income consumers have to spend on your products.

- J.P.Morgan Global Manufacturing PMI which tells us how global purchasing managers feel fell to its lowest level for over six-and-a-half years and posted back-to-back sub-50.0 readings for the first time since 2012.

- Michigan’s Consumer confidence index is holding steady telling us that consumer spending is what is keeping the economy going today.

- Auto sales are down 1.5% Year over Year and sales of new homes were down 5%nfrom last quarter.

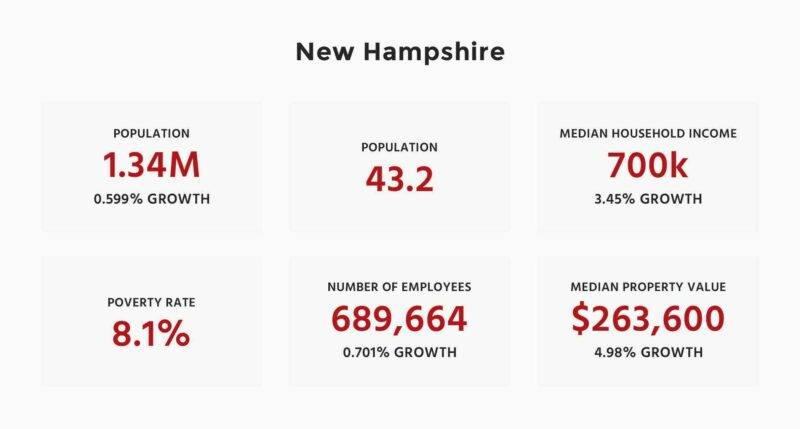

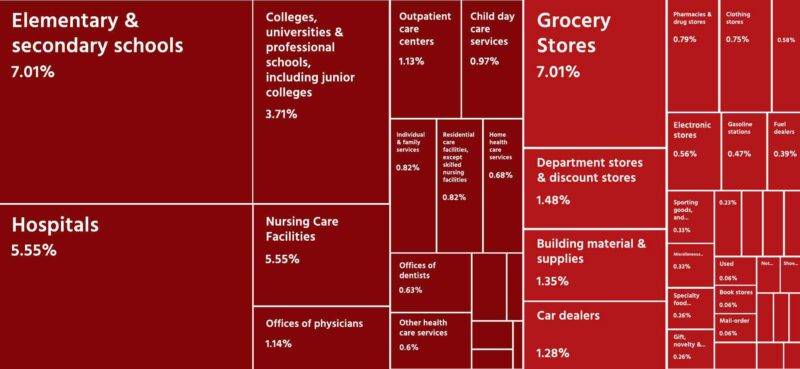

There are clearly clouds on the horizon for the US economy and more importantly your customers. The first thing I like to do is put myself in our customer’s shoes. For example, say you primarily sell a premium food item (think StoneWall Kitchen) B2C in our home state of New Hampshire. I would start by heading to a site like datausa to get an updated feel for our primary customer.

Where do they work:

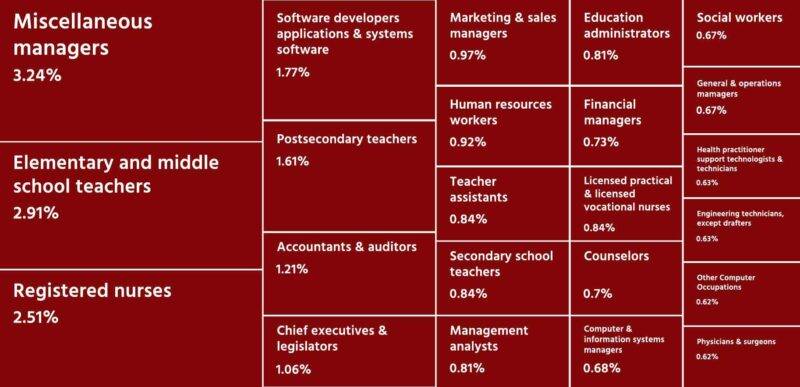

What job might they have:

Ideally you have a few personas built out but as an example let’s use my example of Tammy the Teacher:

- Middle School Teacher

- Median salary $57,522

- 43 years old

- Single head of household

- One kid at home

- Homeowner with a mortgage

What is her disposable monthly income:

- $57,522 – 22% Federal Taxes = $44,876 post Tax Income

- Using data from the BLS we see Tammy typically spends 12.8% of her post tax income on food. With 7.2% being food at home and 5.6% being eaten out.

- This means she has $3,231 dollars yearly and $269 dollars monthly to spend on our product category.

We immediately get a better feel for Tammy and how we might add value to her life in a recession. Let’s say our product sells for an average ring of $30 or 11% of her monthly income. How could we help her stretch that? Could we do 2 pack value bundle? Or partner with another vendor for a meal solution?

Guessing that Tammy is stressed to feed her family as the economy worsens how might we talk to her differently? That really happy upbeat ad you did from last year is going to feel out of sync. Can we recut and rework our messaging to be more in line with Tammy and her family needs? We would then test that new campaign messaging out digitally in Google and Facebook to benchmark it vs our existing ad campaigns. After a few iterations of imagery and copy tweaks, we have the start of our recession playbook. Ready to go as the storm clouds gather.

If we look at data from McKinsey on the 2008 recession we can see that companies that focused on the problem earlier than their peers did better as they came out of the recession. Building out recession based marketing playbooks now won’t take the sting out of the recession but your company will be able to bounce back quicker and stronger having been prepared as the economy recovers.